ProCredit Red Flag Solutions

Your dealership was required to implement an Identity Theft Prevention Program by December 2010. The program requirements include the development of a Compliance Manual and ensure implementation of all requirements therein. When you use the ProCredit Red Flag Rules solution you will receive a template of a Compliance Manual including the Risk Assessment Process developed for our own dealership for you to individualize as necessary.

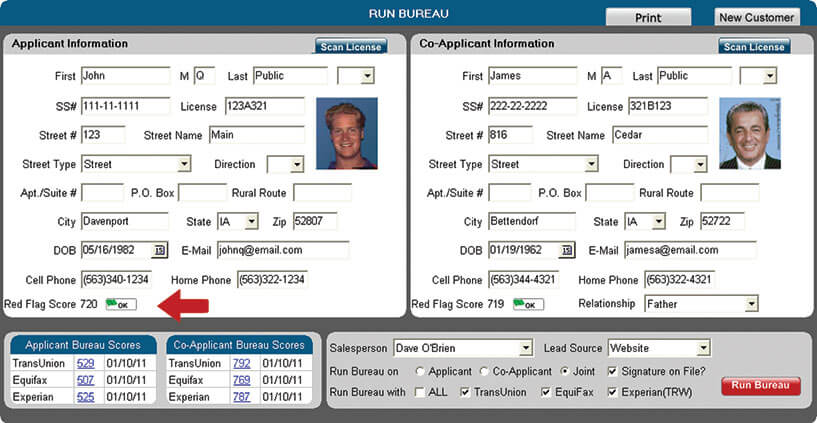

Then, when a credit bureau report is pulled using ProCredit the consumer’s Red Flag “Score” will be accessed.

If the Red Flag “Score” indicates dealership action is required to confirm the consumer’s identity pursuant a message will pop-up in ProCredit informing you further investigation regarding the consumer’s identity is required, at which time you can initiate access to the Red Flag Exam which consists of four “out of wallet” questions. The exam results will then be returned through the ProCredit system. Any required Incident Report can then be completed and stored in ProCredit for annual reports and audits.

How the ProCredit Identity Theft “Red Flags” process works Seamless Red Flag Screening!

Based on certain fraud indicators, a Red Flag Score is generated when credit is pulled in ProCredit.

If the flag is green, no fraud is detected and no further action is required.

If the flag is yellow, the credit information provided has triggered a Red Flag. Automatically, a warning is displayed on the screen indicating further investigation is required to verify the accuracy of the consumer’s identity

Immediate “Out of Wallet” Exam

If you choose to verify the consumer’s identity immediately, you can choose to initiate the Red Flag Exam.

If the questions are answered correctly, the flag turns green and no further action is required.

If the exam is refused, or if the questions are answered incorrectly, the flag turns red.