ProCredit Risk Based Pricing Solutions

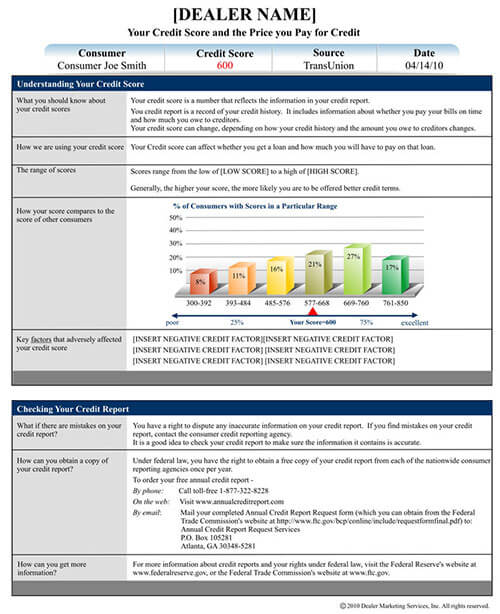

The Federal Trade Commission (FTC) began enforcement of the Risk-Based Pricing Rule on January 1st, 2011. This rule affects all car dealerships that pull credit reports on consumers, and failure to comply can result in heavy fines. Under the Risk-Based Pricing Rule, your dealership is required to present a notice to each consumer that has a credit report pulled. The notice must include their credit score, if they have one, and other information including key factors that may have adversely affected their score. ProCredit has designed a solution based on NADA and NIADA recommendations that fits seamlessly into your sales process. When you pull credit reports in ProCredit, a Risk-Based Pricing Exception Notice is immediately generated. This Exception Notice is easy to read and understand, and fulfills all of your compliance requirements.

How the ProCredit Exception Notice process works

Anytime a credit report is pulled in ProCredit, an Exception Notice is automatically created.

A great cover letter will serve as the initial follow-up and help generate extra sales.

The Exception Notice can now be printed and handed to the customer or we can mail all unsold traffic the notice for you with the great cover letter using our Fail-safe compliance solution, keeping your focus on the deal.

Our Risk-Based Pricing Fail-safe option monitors and tracks the customers to keep you compliant preventing any break downs in your process.